Anúncio

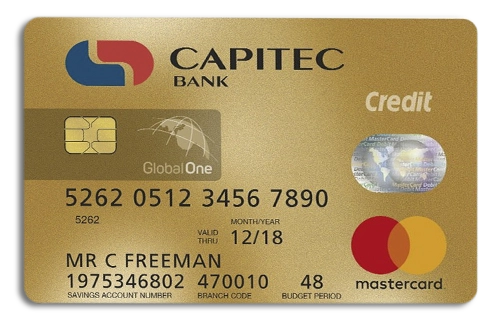

The Capitec credit card offers control and flexibility, with customizable interest rates and adjustable credit limits, ideal for those looking to manage their finances efficiently. Robust security and 24/7 support ensure peace of mind with every transaction.

With this card, you can adjust your limit as needed and enjoy the benefits of a globally accepted card. The app-based management makes controlling expenses easy and practical.

Anúncio

Don’t miss the chance to have a card that adapts to your lifestyle, offering high-quality security and support. Apply for the Capitec credit card and start enjoying its advantages!

About the Capitec

Capitec Bank is one of the fastest-growing financial institutions in South Africa, known for its innovative and customer-centric approach. Founded in 2001, the bank stands out for the simplicity of its financial products and its focus on making banking accessible to everyone.

Anúncio

Capitec offers a wide range of financial services, from current accounts to personal loans and credit cards, always with the goal of providing simple and efficient solutions. The institution is strongly committed to security and customer satisfaction, reflected in its 24/7 customer service and the transparency of its products.

With a constantly growing customer base, Capitec Bank continues to expand its market presence, offering financial products that meet the needs of a diverse audience. The Capitec credit card is a perfect example of how the bank combines innovation, security, and accessibility in its products.

Capitec Benefits

1% Cashback on All Purchases: With the Capitec credit card, you can enjoy 1% cashback on all your purchases, no matter where you spend. This means that every time you use your card—whether for online shopping, in-store purchases, or services—a portion of what you spend is returned to your pocket. This cashback benefit is a great way to save in the long term, turning your daily expenses into a source of savings.

Low Interest Rates Starting from Prime: The card offers one of the lowest interest rates on the market, starting from the prime interest rate. This means you’ll pay less interest on any outstanding balance, making it easier to manage your finances. This advantage is especially useful for those who need to carry a balance from month to month, ensuring that interest charges remain minimal.

Integration with Digital Wallets: The flexibility of the Capitec credit card is one of its strongest points. The card can be easily added to digital wallets like Apple Pay, Google Pay, Garmin Pay, and Samsung Pay, allowing you to make payments quickly and securely using just your smartphone or wearable device. This integration makes managing your payments easier, especially for those who prefer modern, contactless payment methods.

Free Card Delivery: Convenience begins as soon as you apply for your card. The Capitec credit card is delivered to your door at no extra cost, eliminating the need to pick it up at a bank branch. This free delivery not only saves you time but is also more practical for those with busy schedules.

Up to 55 Days Interest-Free: One of the biggest benefits of the credit card Capitec is the ability to enjoy up to 55 days interest-free on your purchases. This means that if you pay your balance in full before the end of this period, you won’t pay any interest on your purchases, allowing you to use credit smartly and economically.

3.0% Annual Interest on Positive Balances: The Capitec card not only offers credit but also rewards any positive balance you maintain on the card. With an annual interest rate of 3.0% on any positive balance, you can grow your funds while using the card, something uncommon with traditional credit cards. This makes the card an even more versatile and profitable financial tool.

Credit History Building: Using the Capitec card responsibly can significantly help in building and improving your credit history. With a good payment history, you can increase your credit score over time, which can be beneficial for future loan or financing applications.

No Fees for Local Purchases: Another important benefit is the waiver of fees for purchases made within the country. This means you can use the card for all your daily expenses without worrying about additional charges, making the Capitec credit card an economical and practical option for local use.

Optional Credit Insurance: For those who want more peace of mind, the credit card Capitec offers the option to purchase credit insurance. This insurance protects your card’s outstanding balance in the event of unforeseen circumstances such as job loss or disability, ensuring you won’t be overwhelmed by debt in difficult times.

Zero Currency Conversion Fees for International Spending: If you love to travel, the Capitec credit card is an excellent choice as it does not charge currency conversion fees when you make purchases abroad. This can lead to significant savings during international trips, allowing you to make the most of your money without the typical bank fees.

Free Travel Insurance up to R5 Million: Another exceptional benefit for travelers is the free travel insurance that covers up to R5 million. With this insurance, you can travel with peace of mind, knowing you’re protected against a range of unforeseen events, from medical emergencies to trip cancellations, at no additional cost.

Capitec Fees and commissions

The Capitec credit card charges a one-time initiation fee of R100, which is applied when the card is activated. This initial fee covers the costs of setting up your credit account.

Additionally, there is a monthly fee of R50 to keep the card active and access all its benefits. This amount is charged directly to your monthly statement.

Interest rates range between 11.75% and 22.25%, depending on your credit profile. These rates are adjusted based on each customer’s individual financial assessment. Rates may change without prior notice, so it’s important to regularly review the terms and conditions.

Positive points

- Flexible Credit Limit:Customize your limit according to your needs.

- Global Acceptance:Use the card at millions of locations worldwide.

- 24/7 Customer Support:Assistance available at any time.

Negative points

- Limited Benefits:The card may not offer as many rewards as others on the market.

- Active Management Required:Regular monitoring of expenses through the app is needed.

- Focus on Digital Management:The management is centered around the app, which may not appeal to everyone.

Capitec Card Limit

The Capitec credit card offers a credit limit of up to R500,000, providing ample purchasing power to meet a variety of financial needs, from daily expenses to larger purchases. The exact limit granted will depend on your credit profile and financial situation.

This flexibility allows cardholders to manage their spending effectively, taking advantage of a higher credit limit, making it a versatile choice for various financial scenarios.

How to apply for Capitec

- Visit the official Capitec Bank website.

- Navigate to the credit card section and select the Capitec credit card.

- Click “Apply Now” and complete the application form with your personal and financial details.

- Submit the required documents, such as proof of income and residence.

- Wait for the credit analysis and confirmation via email or SMS.

How to contact Capitec

If you need assistance or have any questions about the Capitec credit card, you can reach the bank through the following channels:

- Phone: 0860 10 20 43

- Email: [email protected]

Take advantage of the control and flexibility offered by the Capitec credit card. Apply and enjoy all the benefits it can offer!