Anúncio

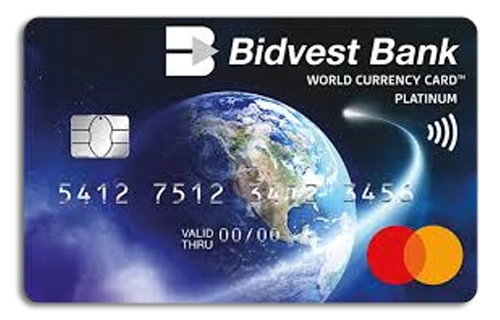

A card with immediate approval gives you quick access to your finances, eliminating long waiting times. Whether for shopping, payments, or travel, this convenience ensures flexibility and peace of mind.

Banks and financial institutions now offer immediate approval, allowing instant access to funds without unnecessary delays. With minimal requirements and extra benefits like cashback and low fees, these cards are a smart choice.

Anúncio

Looking for a card with instant approval and exclusive perks? With so many options available, how do you choose the best one? Keep reading to find out the top choices for you!