Anúncio

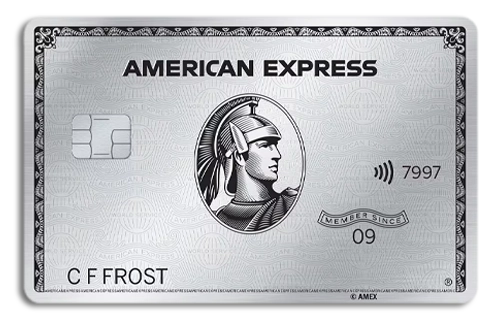

The Nedbank American Express Platinum is a credit card that redefines the concept of exclusivity and rewards. Designed to offer the best in benefits and services, it is the ideal choice for those looking for a card that truly makes a difference in daily life.

With an exceptional rewards program, the Nedbank American Express Platinum allows you to accumulate points quickly on your daily purchases. These points can be redeemed for a wide range of rewards, including travel, luxury products, and unique experiences, allowing you to live the lifestyle you’ve always wanted.

Anúncio

Don’t miss the opportunity to turn your purchases into valuable experiences. Discover everything the Nedbank American Express Platinum has to offer and join an exclusive group of people who enjoy unique advantages. Apply for your card and start living a new financial reality!

About the Nedbank

Nedbank is one of South Africa’s leading banks, known for its commitment to innovation and customer service. With a wide range of financial services, the bank caters to both individuals and businesses, offering tailored solutions to meet the needs of its clients.

Anúncio

With a focus on social responsibility and sustainability, Nedbank is dedicated to promoting economic development and financial inclusion in all the communities it serves. Through its initiatives, the bank seeks to positively impact society and the environment.

The bank is also recognized for its solid governance and security practices, ensuring that its customers can trust the integrity and protection of their data and transactions. With a specialized team, Nedbank is always ready to provide financial support and guidance.

Nedbank American Express Platinum Benefits

Generous Rewards Program: With the Nedbank American Express Platinum, you quickly accumulate points on all your purchases. These points can be redeemed for a wide range of options, such as travel, exclusive products, dining at renowned restaurants, and unique experiences, allowing you to maximize the value of each transaction and enrich your lifestyle.

Exclusive Event Access: Cardholders receive invitations to special events, such as movie premieres, concerts, shows, and luxury product launches. Additionally, you can enjoy unique lifestyle experiences, such as wine tastings, cooking classes with renowned chefs, and VIP access to exclusive exhibitions and fairs, ensuring a vibrant social life filled with opportunities.

Personalized Service: The card’s concierge service is available 24 hours a day to assist with anything you need. Whether it’s making reservations at restaurants and hotels, planning trips, or securing tickets to sold-out events, the concierge is always ready to offer personalized assistance and quick solutions, ensuring that all your needs are met with efficiency and care.

Partner Offers: Enjoy exclusive discounts and offers from a selected network of partners, including luxury hotels, car rentals, and acclaimed restaurants. These partnerships allow you to save on travel and consumer experiences, ensuring that each expense is an opportunity to gain more value and satisfaction.

Purchase Protection: With the purchase protection insurance, your acquisitions are safeguarded against accidental damage or theft for a limited period after purchase. This offers peace of mind when making significant purchases, knowing you have additional coverage in case of unforeseen events, protecting your investments and ensuring greater financial security.

Extended Warranty: The card offers an extension of the original warranty period on eligible products purchased with the card. This means you can enjoy additional protection on your appliances, electronics, and other durable goods, increasing the longevity and reliability of your purchases at no extra cost.

Flexible Payments: The card provides various installment options to help manage your expenses efficiently. With special interest rates for installment payments, you can divide the cost of your purchases into installments that best fit your budget, offering more control over your finances and flexibility in handling larger expenses.

Nedbank American Express Platinum Fees and commissions

The Nedbank American Express Platinum Credit Card charges a service and facility fee of R490 per month. This fee includes various services and benefits that the card offers, such as access to rewards programs and personalized service.

Cardholders can enjoy up to 55 interest-free days on their purchases, providing an excellent opportunity to manage finances effectively. A minimum income of R62,500 per month is required to qualify for the card.

The interest rate is personalized according to the cardholder’s financial profile, ensuring fair and tailored conditions. Additionally, there are no charges for card swipes, offering savings on your daily purchases.

Fees and conditions are subject to change without notice. It is recommended to regularly check with the bank for updates.

Positive points

- Generous Rewards:A versatile and generous rewards program.

- Travel Comfort:Access to VIP lounges at international airports.

- Travel SecurityComprehensive travel protection.

Negative points

- Approval Conditions:Strict requirements for credit approval.

- Income Requirement:High income needed for approval.

- Limited Acceptance:May not be widely accepted at smaller establishments.

Nedbank American Express Platinum Card Limit

The credit limit of the Nedbank American Express Platinum is adaptable to the cardholder’s needs, with a competitive initial amount that can be adjusted based on the client’s usage and credit history. This offers flexibility for larger or emergency purchases.

To adjust the credit limit, the cardholder can contact Nedbank’s customer service. The increase is subject to a credit review, taking into account the client’s payment behavior and income.

How to apply for Nedbank American Express Platinum

- Visit the Website: Go to the official Nedbank website and navigate to the credit cards section.

- Fill Out the Form: Click on “Apply Now” and complete the online application form with your personal and financial information.

- Submit Documents: Submit the required documents, such as proof of income and identification, for review.

- Await Approval: After the review, you will receive a response regarding the status of your application.

How to contact Nedbank

Contact Nedbank for more information or assistance through the following channels:

- Phone: 0860 555 111 (within South Africa)

- Email: [email protected]

Transform your purchases into valuable experiences with the Nedbank American Express Platinum. Apply and start enjoying all the advantages that only a premium card can offer!